Read Time: 4 Minutes

3 Steps To Renew Your Mortgage Like A Pro

Ever wonder how to rock mortgage renewal?

These three steps will help you turn the renewal from burden to opportunity!

Mortgage rates are higher than they’ve been for 15+ years, and so understanding the renewal process and the opportunity is more important than ever.

By getting a head start, making a plan, and putting it into action, you’ll identify savings, reduce stress, and maybe even access some extra cash!

Now, let’s dive in.

Start Early

Starting the mortgage renewal process early gives you the space needed to make informed decisions that will impact your financial future.

By beginning the process at least 5 months before renewal, and even as far out as 13 months, you allow time to review your current financial position, mortgage rates and trends, and consider future needs.

Now let’s take a look how this could play out, imagine two homeowners, both with upcoming mortgage renewals.

Homeowner A starts the process a month before their renewal.

They feel rushed, stressed, and lack the time to explore options – they get stuck renewing with their current lender under terms that are going to cost them money down the road.

On the flip side, Homeowner B starts 5 months before renewal.

They are able to assess their situation, thinking about upcoming needs and goals, understanding current mortgage rates and where they are going, and make a plan with their mortgage broker. ;)

As a result, Homeowner B enters their renewal with confidence, protects themselves from rate changes, and even discovers opportunities to optimize their mortgage terms, ultimately saving money and reducing stress in the long run.

Avoid the regret, and enjoy the peace of mind and financial security that come with starting early.

Build Your Strategy

The goal here is build a plan to support your current and future financial goals and circumstances.

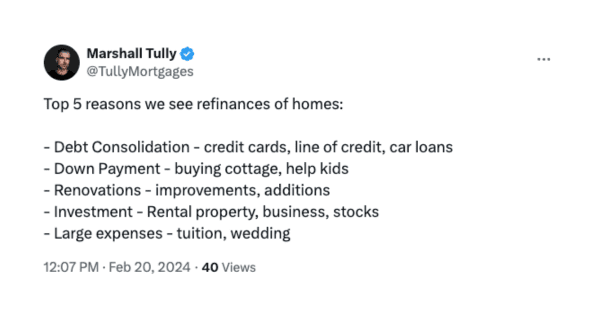

You’ll want to think about things like;

- paying off any debt

- reducing mortgage payment

- getting access to some extra cash

- current or upcoming renovation needs

- any future plans around selling the property

Understanding where rates are, and where they are going, also ensures that you select the right rate and timeline, to maximize the benefits of your mortgage renewal.

Now again, imagine our two homeowners…

Homeowner A simply accepts the renewal offer from their current lender without exploring other options or considering their financial goals – and misses out on some really important opportunities.

They have $25k in debt, and could have increased their mortgage slightly at renewal to pay off the debt, and reduce their monthly expenses as well as potentially saving any damage to their credit.

Additionally, they fail to think about future plans for the property, which they are planning to sell in 3 years to move to something smaller.

They lock into a new 5 year fixed with their lender as it has the best rate, and this ends up costing them thousands when they sell in 3 years – eating up profits they planned to use for early retirement.

On the other hand, Homeowner B takes the time to build a strategic approach to their mortgage renewal.

They press their current lender for the best offer, and then shop around for better offers with their mortgage broker. ;)

They also know they have a few home improvements coming up this year, including redoing the roof, rebuilding the back deck, and need some extra cash to help with their daughter’s university expenses.

As a result, they are able to borrow a bit more money with the mortgage to cover the extra expenses, and come up with a plan with their broker so their monthly payment doesn’t change too much either.

By understanding current rates and where rates are going, they select the right timeline, avoiding locking into higher rates for too long – putting more money in their pocket, not the banks.

By building a solid plan for your renewal, you take care of your needs today, while protecting your plans for retirement.

Execute Your Plan

Putting your mortgage renewal plan into action, is like putting the final piece of the puzzle in place.

We crafted your plan around your current situation and your future goals.

So first, we’ll want to figure out if your current lender fits with your plan.

If they do, we don’t settle for their mediocre initial offer; we’ll push them; letting them know you’re willing to leave to get their best offer.

Then we can determine whether sticking with your current lender makes sense or if it’s time to explore other options.

If you stick with your current lender, the process is straightforward – simply sign and go, so we’ll want to make sure moving on is an option for you, and is worth the extra work.

Next, we’ll research and compare options to find the best fit for your renewal.

This will involve checking credit, updating your borrower profile, and collecting supporting documents, just like you did when you first got a mortgage.

Following this guide, will ensure you seize the opportunity during mortgage renewal, and set you up for financial success.

Whether you stick with your current lender or explore new options, the key is to make an informed decision to align with your goals and priorities.

Overview

Subscribe to begin.

Join 7.5k+ subscribers and get a tip, strategy or market update to help optimize mortgage your every other Thursday morning.