Read Time: 4.5 Minutes

Understanding the Impact of Bank of Canada Interest Rate Announcements

After the Bank of Canada rate cut in June, I got many calls from clients.

They wanted to understand the impact on their mortgage and finances.

Another announcement is scheduled for July 24.

I’ll share some insight on how these announcements affect mortgage rates and payments.

Tuesday’s inflation was 2.67% for June, the lowest in 3+ years.

As a result, many experts predict a rate cut next week.

Estimates are for a total of 2% in cuts over the next 3 years (most of that coming in the first 2 years).

Many things trigger a rate cut, and impacts fixed rates and variable rates differently.

Understanding this brings much clarity.

It can really ease anxiety about making mortgage decisions.

So, let’s dive in.

The basics of Bank of Canada rate changes

When does the Bank of Canada make changes?

The Bank of Canada holds eight policy meetings a year to review and adjust the key interest rate.

Staying informed about these dates can help you anticipate potential changes in mortgage rates.

The next meetings for 2024 are scheduled for:

– July 24

– September 6

– October 25

– December 6

Why does the Bank of Canada make changes?

The Bank of Canada’s purpose is to keep the price of things growing around 2% a year, and to support the Canadian economy.

Several key factors influence the Bank of Canada’s decision on interest rates, including:

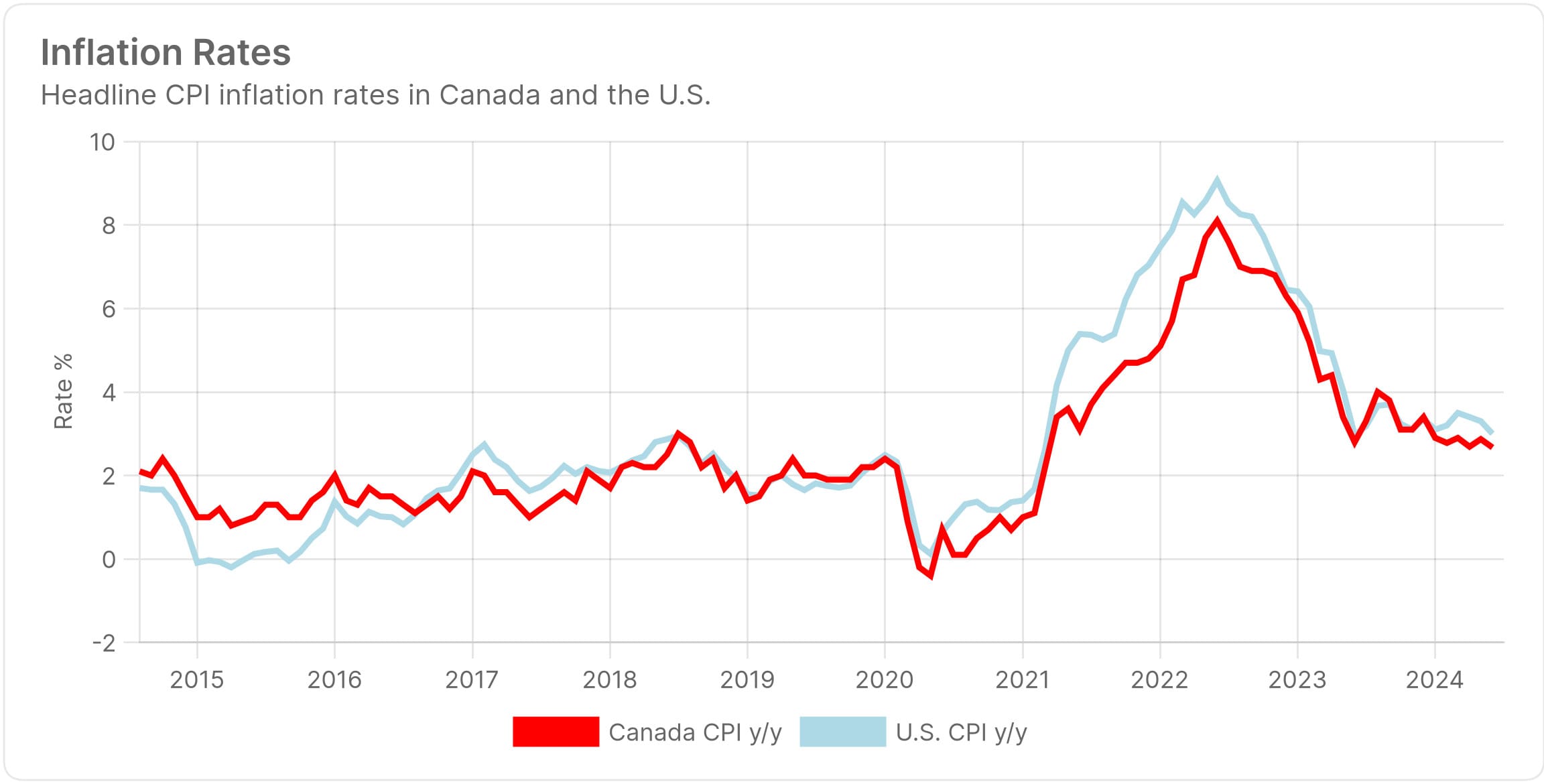

Inflation:

Inflation is the year-to-year change in the price of things we buy.

If it is above the Bank of Canada’s target, rates may rise to cool down the economy.

Inflation peaked at 5.5% in late 2022.

The 2.67% report we got this week is the lowest in over 3 years.

It sets the stage for our next cut.

And believe it or not, about 50% of the 2.67% is attributable to high interest rates controlled by the Bank of Canada.

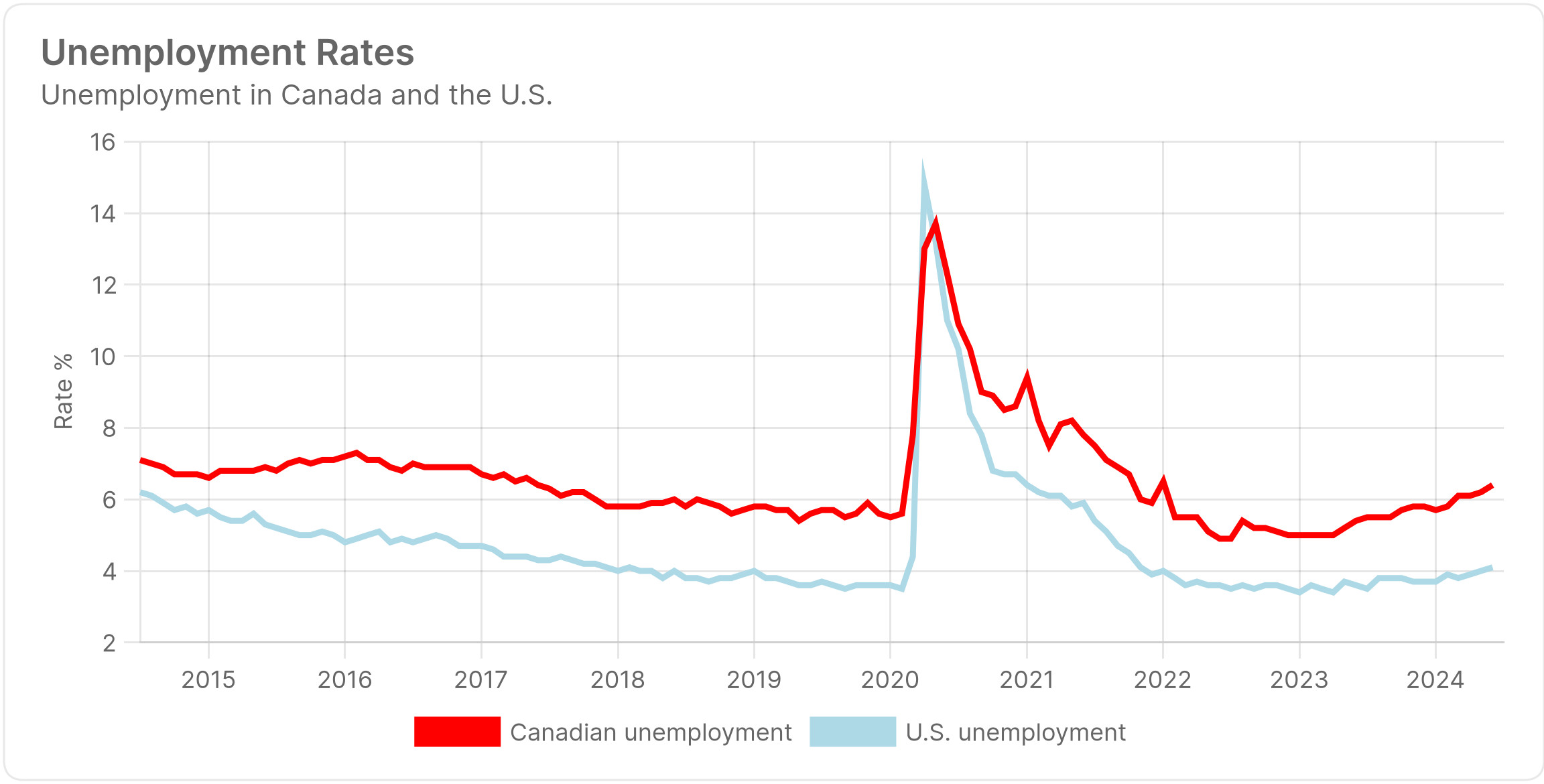

Employment:

Employment rates look at the percentage of the population that is currently unable to find work.

High employment rates can lead to rate increases, while rising unemployment would prompt rate cuts.

The unemployment rate has been increasing all year, with Ontario hitting 7% for Q2 of 2024.

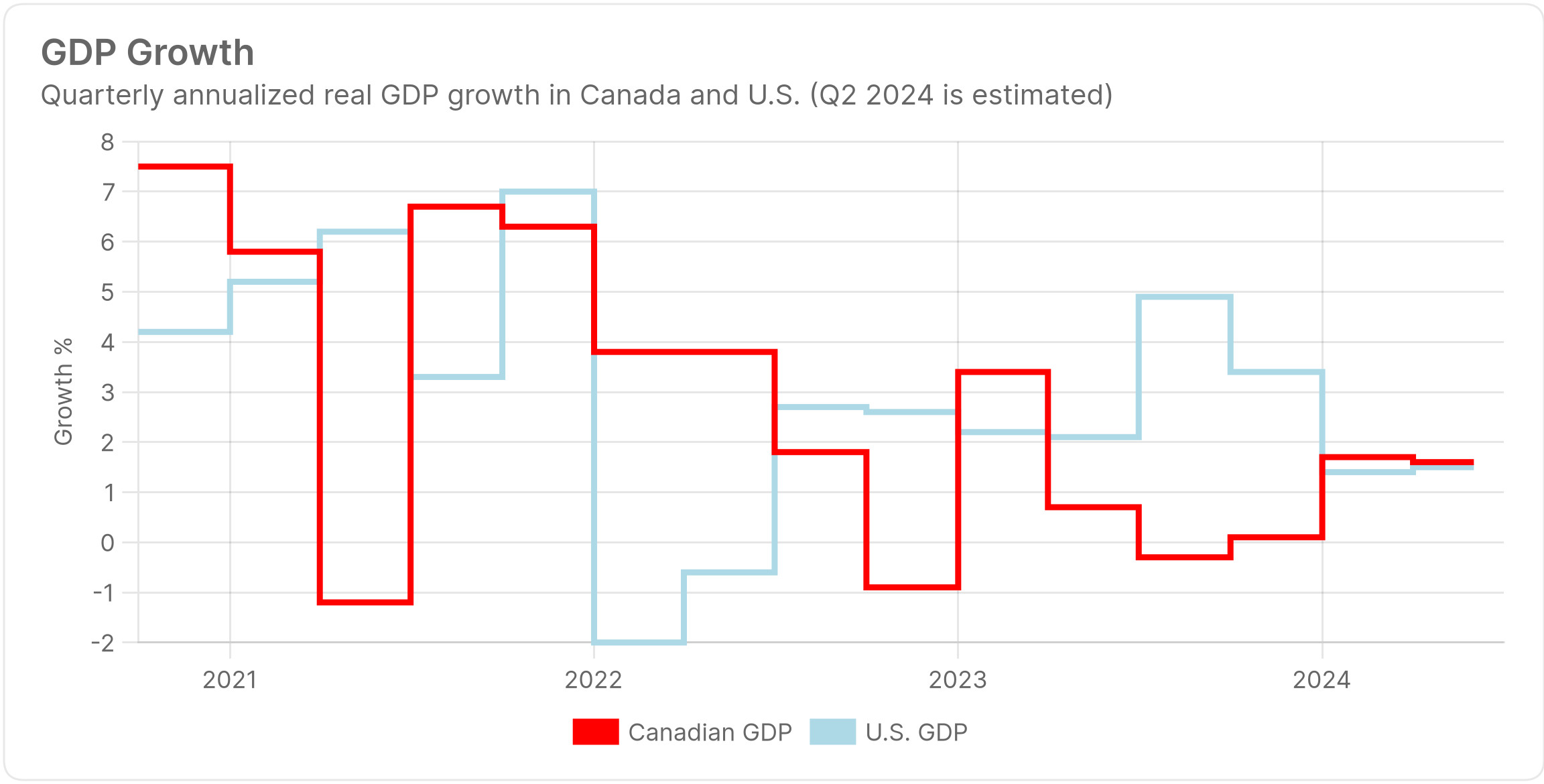

Economic Growth:

Economic growth is how much our economy grows each year.

It is typically measured by Gross Domestic Product (GDP).

Strong growth can lead to higher rates.

Signs of slowdown can result in rate cuts.

Canada has seen a few quarters of slower economic growth, which is very different from that in the US.

This problem is worse when you look at our GDP per person.

Our population has grown recently.

So, our GDP should be growing, not shrinking.

Impact on Fixed Rates

Why Fixed Rates Do Not Change with Rate Announcements

The nature of a fixed rate is it stays the same for the term, so anyone with a fixed rate currently sees no impact.

Where you might see a change is fixed rates that would be available to someone negotiating a new fixed rate term.

Bond market yields, not the Bank of Canada’s rate, mainly affect fixed mortgage rates.

When the Bank of Canada adjusts the overnight rate, it indirectly affects the bond market.

For instance, expectations of future rate cuts can cause bond yields to fall, thereby affecting fixed mortgage rates.

However, the BoC’s immediate key rate changes do not directly alter fixed mortgage rates right away.

This is because most rate changes are predicted well before the announcement.

So, fixed rates have already factored in the change.

Sudden or unexpected rate changes, or changes that come sooner than expected can impact the fixed rates available.

When to consider breaking a fixed rate

Refinancing your mortgage can help, when fixed rates are lower than your current rate.

This often happens when bond yields drop significantly, typically when the Bank of Canada rate cut cycle begins.

If you’re stuck in a higher fixed rate, refinancing to a lower rate can cut your monthly payments.

It can also save you thousands over the life of the mortgage.

Consider refinancing if the savings outweigh the penalties for breaking your existing mortgage.

For most banks, the penalty to break your fixed rate mortgage is lowest in the first 6 months after you take the mortgage.

It is also lowest in the last 9 months before the term ends.

How cuts impact outlook for fixed rates

Fixed rates aren’t tied to the Bank of Canada’s key rate.

However, economic expectations from these announcements can influence fixed rates.

For instance, if the Bank of Canada signals economic uncertainty, bond yields may fall.

This could lower fixed mortgage rates.

Watching the Bank of Canada’s economic outlook can help you predict fixed rate changes.

It will help you make smart choices about refinancing or locking in a rate.

With rates expected to be lower rates in 2 years, fixed rates of 3 years or more carry lower rates.

As we get closer to the big rate cuts, we should see rates for 2-year terms start to drop, then, 1-year terms will follow.

Impact on Variable Rates

The lender’s prime rate affects variable-rate mortgages.

It is based on the Bank of Canada’s key interest rate changes.

There are two types of variable-rate mortgages in Canada:

Adjustable-Rate Mortgages (ARMs):

Your monthly payments change as the interest rate fluctuates.

So a rate cut by the Bank of Canada would automatically make your next payment lower.

Variable-Rate Mortgages:

Monthly payments remain the same, but the portion going towards interest versus principal changes with the rate.

So a rate cut by the Bank of Canada would mean more of your next mortgage payment would go to repaying the balance owing, as less is owed on interest.

How a 0.25% Rate Cut Impacts Your Payment

A 0.25% cut in the Bank of Canada’s key rate typically results in a 0.25% reduction in your lender’s prime rate.

For adjustable-rate mortgages, this means your monthly payment will decrease.

The impact is a reduction of about $15 a month for every $100,000 in mortgage outstanding.

Example: You owe $500,000; your payment will drop by about $75 a month.

For mortgages with variable rates and fixed payments, a lower rate means more of your payment goes to paying the principal, not interest.

You can request a lower payment with rate drops.

But, lenders want to see that you are on or ahead of schedule on your initial amortization timeline (full time to repay your mortgage).

By understanding these forces, and by staying informed about upcoming Bank of Canada meetings and economic signals. You can make good choices about your mortgage and financial planning.

The Bank of Canada’s interest rate announcements have a significant impact.

They affect both fixed and variable mortgage rates.

The rate changes should impact your financial planning.

Overview

Subscribe to begin.

Join 7.5k+ subscribers and get tips, strategies and market updates every other Thursday morning.