WANT TO REFINANCE YOUR HOME?

Find out what you can borrow from you home to consolidate debt, renovate, or use for an investment opportunity now.

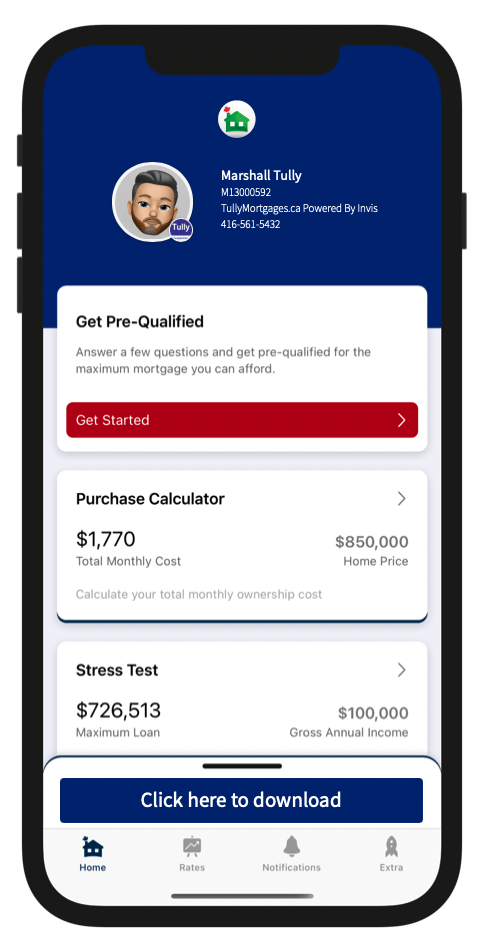

↓ TRY OUR MAXIMUM REFINANCE CALCULATOR

WHY WOULD I REFINANCE MY HOME?

WHAT DOES REFINANCING MEAN?

Refinancing your home or your mortgage means to pay off your current mortgage, and replace it with a new one. Typically the new mortgage is larger, but not always, than your current mortgage. You would use that new mortgage to pay off your current mortgage, and then if the new mortgage is larger – you’d have some leftover funds – to pay down debts, complete renovations, buy another property or invest.

The main reasons you might look to refinance your mortgage are;

To obtain a lower interest rate on your mortgage

To lower your monthly payment on your mortgage, to improve your monthly budget/cash flow

To access the equity in your home to raise funds for a financial emergency, consolidate debt, finance a large purchase (another home or rental property), investment opportunities or pay for renovations.

When determining if it makes sense to refinance your home or not, the biggest consideration is usually what it will cost to get out of your current mortgage. If the cost isn’t to large, then lower interest rates could help offset this. If it is larger, then the costs savings of consolidating debt into your mortgage could allow this to make sense. The minimum penalty for getting out of mortgage is usually about 3 months interest on your mortgage, however if you have a fixed rate mortgage the penalty could be quite a bit higher. If you’re into the last 3 months of your current mortgage term, the penalty could be quite small or non-existent. The other costs you’ll have will be a lawyer fee to register the new mortgage (about $1500 – $2500), and potentially an appraisal (about $500).

The factors that determine how much you can borrow are two main items:

How much is your home worth? The most you can borrow is 80% of the current value.

How much can you afford? We look at how much mortgage you can carry based on your income.