Land Transfer Tax Toronto – A Comprehensive Guide

Welcome to our comprehensive guide on Land Transfer Tax for Toronto (LTT) in Canada. As a dedicated mortgage broker serving the City of Toronto, Ontario area, I am committed to providing you with valuable insights into various aspects of homeownership, including essential information about LTT.

Understanding Land Transfer Tax

Land Transfer Tax (LTT) is a provincial tax imposed on the acquisition of real estate properties in Canada. It is a crucial consideration that is often overlooked when calculating the total cost of purchasing a home. With the exception of Alberta and Saskatchewan, all provinces in Canada levy this tax, although the rates and regulations may vary.

In most provinces, LTT is calculated as a percentage of the property’s value, typically based on the property’s purchase price. However, in Toronto, homebuyers face an additional municipal land transfer tax.

To help ease the financial burden, certain provinces and municipalities offer LTT rebates for first-time homebuyers, providing an opportunity to recover a portion of the tax paid.

Calculating Land Transfer Tax

The calculation of Land Transfer Tax is relatively straightforward; it is determined based on the purchase price of your property. Each province in Canada sets its own LTT rates, and in some cases, municipalities may have their own rates. To find the specific LTT amount applicable to your property, you can use online calculators tailored to your location.

For a detailed breakdown, let’s examine the Land Transfer Tax rates in Ontario:

- First $55,000: 0.5%

- $55,000.01 to $250,000.00: 1.0%

- $250,000.01 to $400,000.00: 1.5%

- $400,000.01 to $2,000,000.00: 2.0%

- Over $2,000,000: 2.5%

City of Toronto residents should be aware of an additional municipal Land Transfer Tax, which follows a similar rate structure.

Land Transfer Tax Rebates for First-Time Homebuyers

First-time homebuyers in Ontario and Toronto can benefit from LTT rebates, providing financial relief during the home buying process. Here are the key details:

Ontario Land Transfer Tax Rebate:

- Maximum Rebate: $4,000

- Eligibility Criteria:

- Canadian citizenship or permanent residency

- Age of 18 or older

- Occupying the purchased home within nine months

- No prior homeownership worldwide

Land Transfer Tax Toronto Rebate:

- Maximum Rebate: Up to $4,475

- Eligibility Criteria (similar to Ontario’s criteria)

Frequently Asked Questions

- Who pays Land Transfer Tax? In most provinces, anyone acquiring land or a beneficial interest in land is required to pay LTT, with exceptions in Alberta and Saskatchewan.

- How can I avoid paying Land Transfer Tax? In Alberta and Saskatchewan, LTT is not applicable. In other provinces, specific circumstances, such as property transfers within families, may exempt you from LTT.

- Is there a Land Transfer Tax rebate? Some provinces offer LTT rebates for first-time homebuyers, such as Ontario and British Columbia, while others do not.

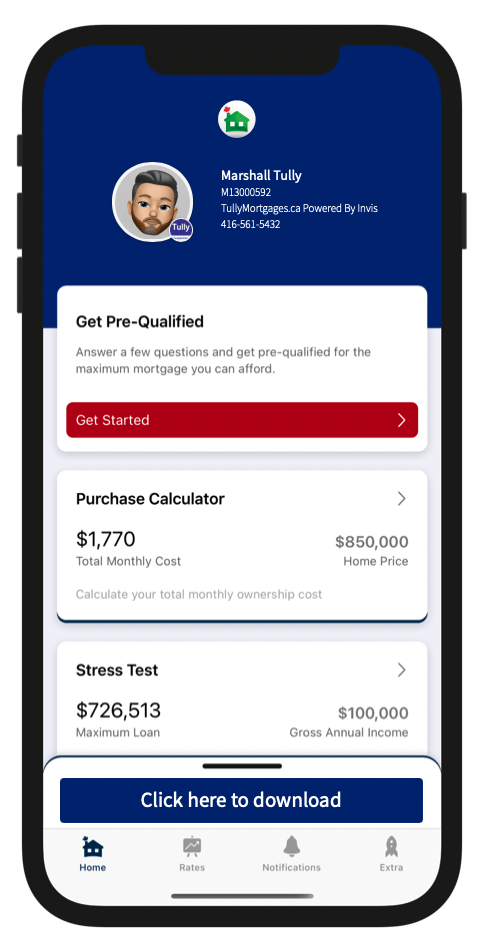

This guide aims to demystify the Land Transfer Tax landscape for homebuyers in Canada. If you have any questions or need further assistance, please do not hesitate to contact Marshall Tully. Your homeownership journey is important, and I am here to ensure it is as smooth and informed as possible.