Smart ways to pay for your home renovation

Moving is a lot of work and it’s expensive when you factor in all the costs – legal fees, moving costs, real estate commission, decorating, furnishings, and so much more. Sometimes it just makes more sense to love your home instead of listing it.

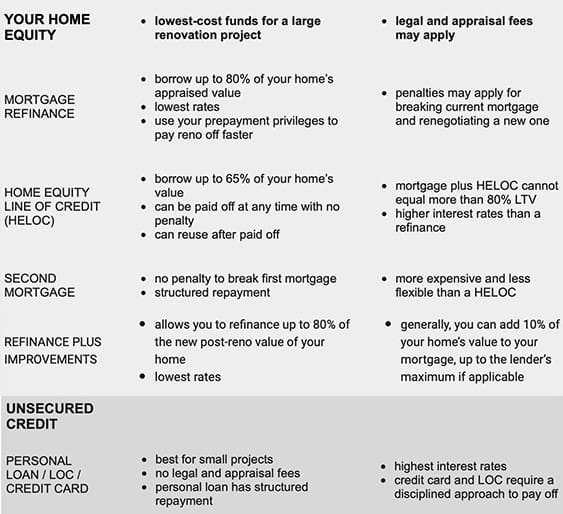

If you’re thinking renovation, you’ll want to carefully look at how to finance that transformation. There are generally two financing routes – home equity and unsecured credit.

Our hot housing market has greatly increased home values, and with mortgage rates hovering around historic lows, homeowners with enough equity are seizing the opportunity to tap into that equity to create the perfect home that fits their lifestyle and to further boost long-term value.

You can access your home equity through a mortgage refinance, home equity line of credit, a second mortgage or a program called refinance plus improvements. For smaller projects, many look to unsecured credit like a personal loan, line of credit, or credit cards. Here are the benefits and considerations of each:

If the home of your dreams is one renovation away, let’s discuss which option is best for your situation. I’m here to help you maximize your bottom line and personal home enjoyment.

Overview

Subscribe to begin.

Join 7.5k+ subscribers and get tips, strategies and market updates every other Thursday morning.