Read Time: 3 Minutes

The Biggest Opportunity to Save on Your Mortgage Happens After You Close

Most homeowners think the mortgage process ends when the paperwork is signed.

You move in, set up your payments, and that’s that.

But what if the real opportunity to save money comes after the deal is done?

Now, let’s dive in.

Why Most Canadians Miss Out on Huge Savings

Once your mortgage closes, it’s easy to go into autopilot.

You make your monthly payments.

You track your spending.

Maybe you even keep an eye on rates when renewal time approaches.

But what about the years in between?

For most Canadian homeowners, their home is the largest investment they’ll ever make.

Yet, unlike RRSPs or stocks—where your financial advisor regularly checks performance—your mortgage is often ignored for years.

This is where we see the biggest missed opportunity.

Active Mortgage Management: The Missing Link

Think of your mortgage like your investment portfolio.

You wouldn’t leave your TFSA untouched for five years, right?

Your home financing deserves the same attention.

That’s where active mortgage management comes in.

It’s the process of tracking key performance indicators that can help you unlock real savings, equity access, and better financial options.

Every month, we monitor these four key metrics for our clients:

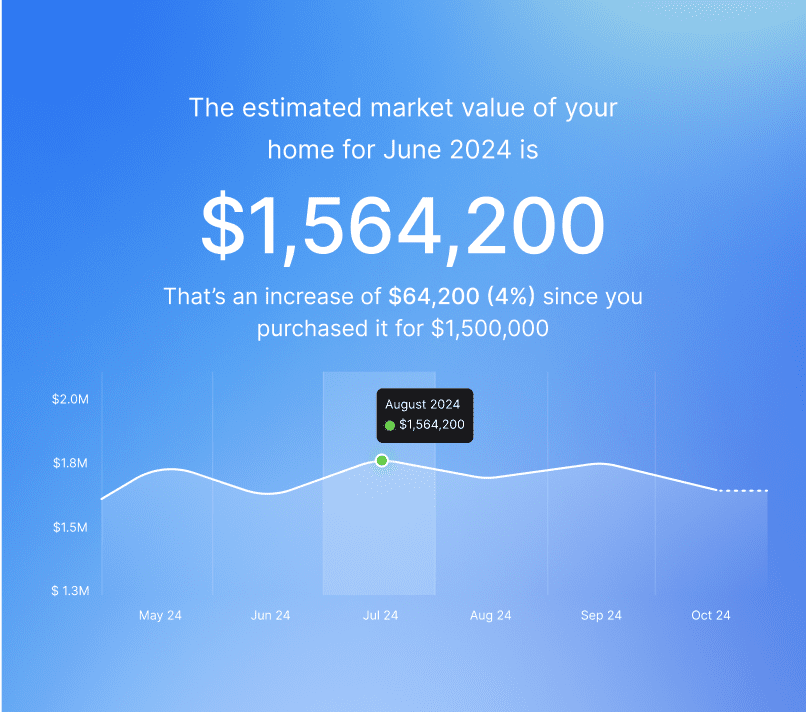

1. Your Home’s Estimated Market Value

Knowing what your home is worth today matters.

Why? Because it impacts everything from your equity to your refinance options.

We use real-time data to estimate your home’s value—so you’re always aware of how your investment is performing.

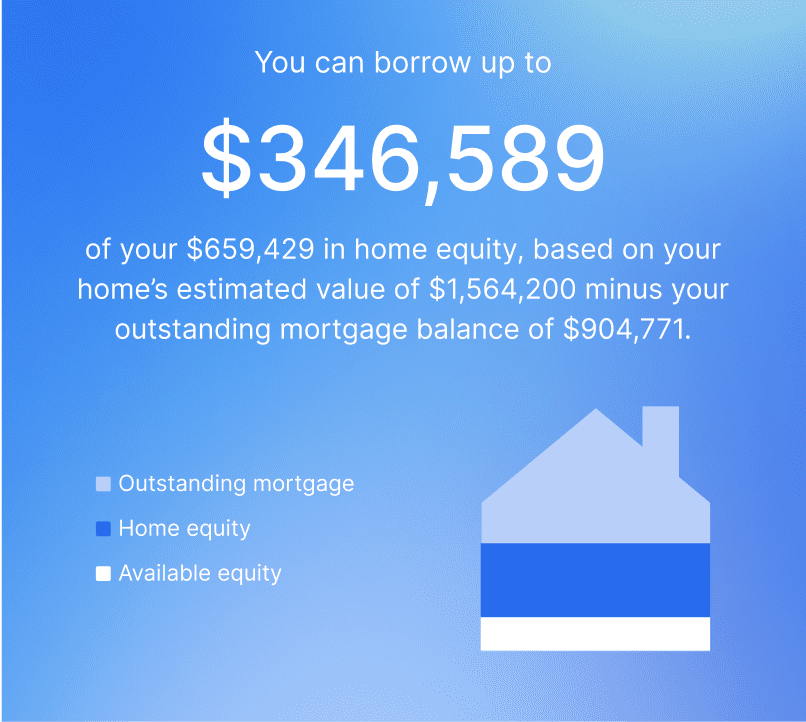

2. Your Current Home Equity

As your mortgage balance decreases and your home value rises, your equity builds.

This equity can be tapped for:

- Renovations

- Investing in a second property

- Funding a business or major life goal

Learn more about accessing equity in our refinance guide.

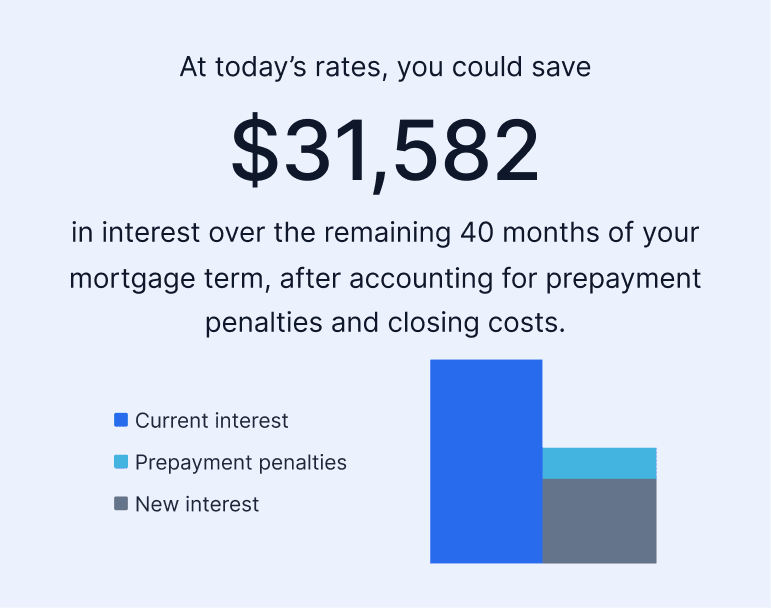

3. Opportunities to Break & Save

Rates change.

Sometimes, the penalty to break your mortgage early is less than the interest you’d save by switching.

But most people don’t even check.

We track this for you automatically.

And if the math makes sense, we’ll reach out and walk you through the options.

Curious about the difference in mortgage payments at different rates?

Explore our mortgage calculator for some quick numbers.

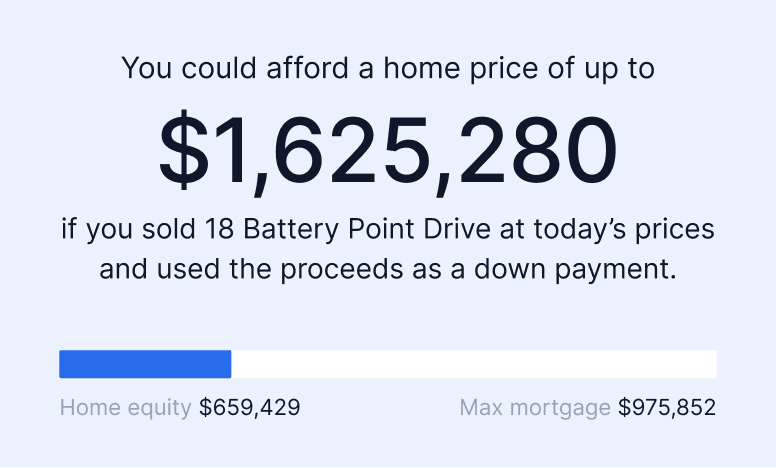

4. Your Updated Purchasing Power

Thinking about upsizing, downsizing, or buying an investment property?

Your borrowing power changes as:

- Rates shift

- Your equity grows

- Market conditions evolve

We’ll tell you what you could afford today—based on your current mortgage, home value, and lending criteria.

This helps you make smart moves without needing a full application every time.

Why the Monthly Mortgage Tracker

Our clients wanted to know:

“When’s the best time to refinance?”

“How do I know if my home equity is growing?”

“Should I wait to renew, or act now?”

So we got a solution: a free monthly report that tracks your home value, equity, mortgage status, and opportunities to save.

We send it directly to your inbox, so you always know where you stand—and when to make a move.

Sign up here to start tracking your mortgage:

Common Questions from Clients

Is there a downside to paying off a mortgage early?

Yes—some lenders charge a prepayment penalty, especially on fixed-rate mortgages.

But we can calculate whether the savings outweigh the penalty.

You also want to make sure you are prioritizing the right things.

Getting your mortgage paid off quickly is very important, but not if it means sacrificing retirement savings.

Balance is key!

What’s the penalty for paying off early?

It varies by lender and rate type.

Fixed mortgages often use the greater of three months’ interest or the interest rate differential (IRD).

We break it all down for you in real dollars inside our reports.

How can I reduce my mortgage payments?

Options include refinancing at a lower rate, extending your amortization, or using equity to restructure your debt.

We can walk you through the most cost-effective option.

How do I pay off my mortgage faster in Canada?

Prepay regularly (up to your lender’s annual limit), make biweekly payments, or lump sum contributions.

We’ll let you know if accelerating payments makes sense for your unique mortgage.

We can help you navigate your options today!

Contact us to learn how we can help you navigate the mortgage process with confidence.

Overview

Subscribe to begin.

Join 7.5k+ subscribers and get tips, strategies and market updates every other Thursday morning.