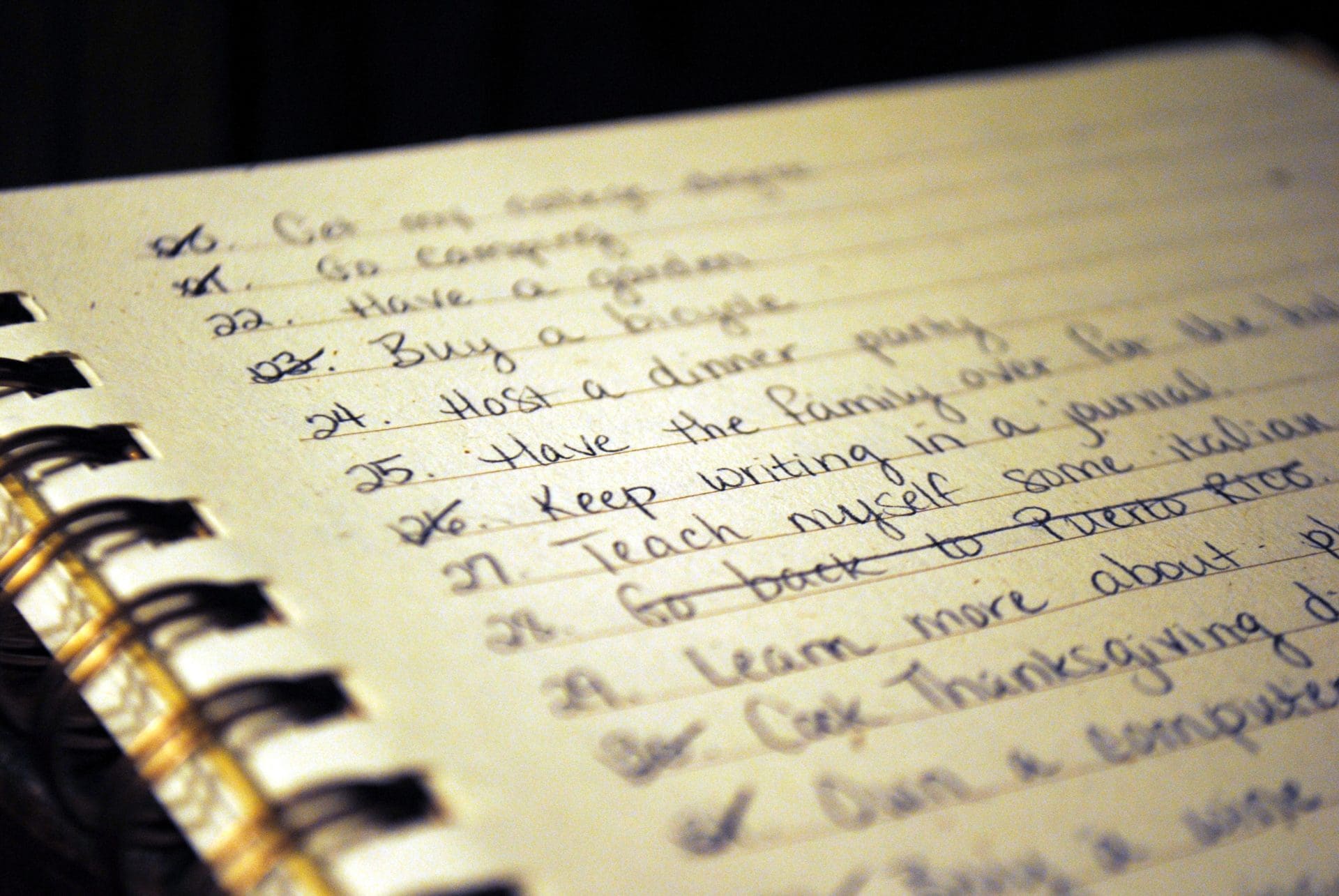

Your bucket list includes all the goals you want to achieve, and the life experiences and dreams you want to fulfill. It’s often viewed as a “to-do” list for the golden years of retirement, but your bucket list can also include items that you can fulfill now or in the near future. Financial resources are often needed to knock items off your list, which is why your mortgage should always be a top focus. Your mortgage is the cornerstone of a sound financial plan, and can help you take control of your financial future so you’ll be better able to achieve all that is on your list.

Here are some tips to help you do just that!

- Speed up your mortgage paydown. Try to find a way to use your prepayment privileges every year… at least once. Tax refund, financial gift, small inheritance… or just being more disciplined with your savings.

- Deal with high interest debt. If your credit card balance is more than you can pay off in the next few months – and especially if you have other loans – then you need to start a paydown plan. The right debt consolidation strategy could save you thousands and put you on the right financial path.

- Sharpen your focus at renewal. When your lender sends you a letter saying it’s time to renew… then it’s time to get an expert second opinion. Make sure you’re getting the best deal possible!

- Renovating over relocating. The right renovation might be all it takes to turn the house you’re in, into the home of your dreams. It is almost always less expensive to renovate than to relocate! There are great financing options available if that’s what’s in your future this year!

- Take care of your credit. It’s so important to have good credit behaviours so you always qualify for the best mortgage rate. Pay your bills on time. Don’t let your credit accounts exceed 30% of the credit available. Before you cancel any credit cards, get advice. And don’t apply for a store card just to save on your purchase that day!

- Choose low-interest debt. Whatever your need might be – funding education, a large purchase, investments, renovations, or paying down debt, your mortgage might be your most cost-effective financing option.

- Don’t leave money on the table. If you bought your first home last year, you may be able to take advantage of the $5,000 non-refundable Home Buyer Tax Credit amount, which provides up to $750 in federal tax relief. Not sure if you qualify, ask!

- Separation or divorce? Your home can be the asset that gives you both a fresh start. And if one of you wants to keep the marital home, there are some great mortgage options available!

- Mortgage checkup. Get one every year, no matter where you are in your mortgage. Your car gets taken in for regular servicing; shouldn’t your financial future get the same kind of attention?

When you take responsibility for your life and your finances, you can achieve all that is on your bucket list. Your mortgage is a key component, and I’m here to help make sure it will get you where you want to go!

Overview

Subscribe to begin.

Join 7.5k+ subscribers and get tips, strategies and market updates every other Thursday morning.