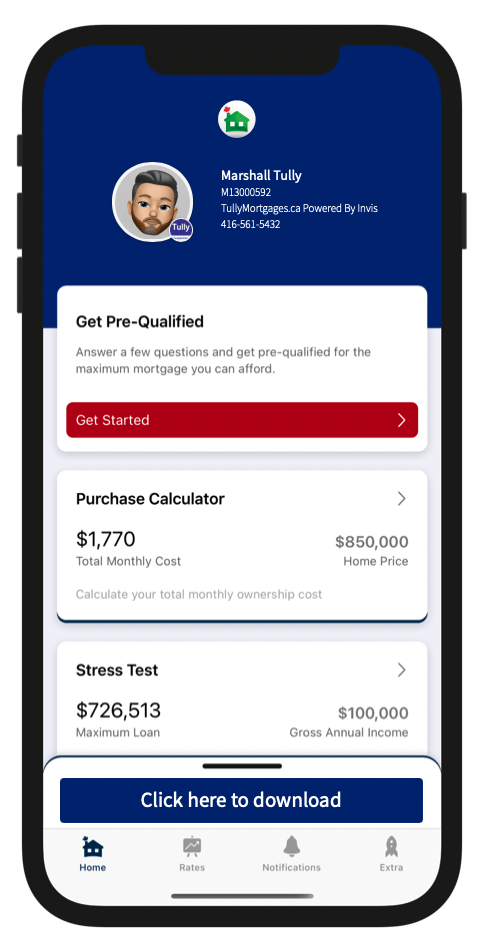

Calculate the carrying cost of your next home!

Hi-I’m Marshall Tully, a Mortgage Broker.

Over the past decade I have worked with 440+ clients helping them borrow more than $225,000,000. With my newsletter I look to pass along my knowledge and experience in the hopes that it can be useful in assisting you navigate your real estate journey.

A bit about me, I graduated with a major in Finance with a Commerce Degree from Dalhousie University in 2006, and have been self-employed since graduating. I’m passionate about my family, my financial success, and my mental and physical health, and working with great clients – I carry all of this with me daily, and you will see it rolled into my articles.

…

As a mortgage broker in Toronto, I understand that navigating the complexities of home financing can be overwhelming. My mission is to help you explore a wide range of mortgage options, making financial decisions with confidence and ease.

I don’t merely ask, “How can you get a mortgage?” Instead, I ask, “What are your financial goals, and how can the right mortgage help you achieve them?” By understanding your unique needs, I tailor solutions that support not only your immediate housing aspirations but also your long-term retirement planning through strategic real estate investment.

In this journey, I prioritize clarity and simplicity. My approach is to demystify the mortgage process, ensuring you’re well-informed and comfortable at every step. Whether you’re a first-time homebuyer or a seasoned investor, my role is to guide you towards financial decisions that align with your life’s objectives.

Ultimately, it’s not just about acquiring property; it’s about securing your future and achieving the freedom to live the life you envision. Let’s embark on this path together, where your financial security and peace of mind are the foremost priorities.

Subscribe to begin.

Join 7.5k+ subscribers and get a tip, strategy or market update to help optimize mortgage your every other Thursday morning.

EASY. PATIENT. PROFESSIONAL.

WHAT MY CLIENTS SAY

QUICK. EASY. EDUCATIONAL.

HOW IT WORKS

TRY OUR CALCULATORS

Payment Calculator →

See how much your payments could be based on different mortgage amounts, amortization, or terms.

Affordability Calculator →

Get an idea of what you could afford to spend on a home based on your current financial situation.

Refinance Calculator →

See how much you could borrow against your existing home, factoring your current financial situation as well as anything you currently owe against the home.

Land Transfer Tax Calculator→

Calculate the land transfer tax based on the specific location you are looking to buy, as well as factoring in any first time buyer rebates (if applicable).

Closing Cost Calculator →

Calculate the total closing costs you’ll need to consider, including land transfer tax, appraisal, home inspection, lawyer, title insurance, moving costs and more.