Is It Time to Refinance? Signs You Could Benefit

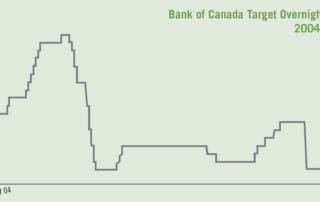

Read Time: 3 Minutes Is It Time to Refinance? Signs You Could Benefit Mortgage refinancing can be a strategic move to lower monthly payments or access home equity. In 2024, with interest rates having dropped by over 1% and lower-than-usual penalties from [...]